Online courses directory (841)

Topics covered in a traditional college level introductory microeconomics course. Production Possibilities Frontier. Opportunity Cost. Increasing Opportunity Cost. Allocative Efficiency and Marginal Benefit. Economic Growth through Investment. Comparative Advantage Specialization and Gains from Trade. Comparative Advantage and Absolute Advantage. Law of Demand. Price of Related Products and Demand. Changes in Income, Population, or Preferences. Normal and Inferior Goods. Inferior Goods Clarification. Law of Supply. Factors Affecting Supply. Market Equilibrium. Changes in Market Equilibrium. Price Elasticity of Demand. More on Elasticity of Demand. Perfect Inelasticity and Perfect Elasticity of Demand. Constant Unit Elasticity. Total Revenue and Elasticity. More on Total Revenue and Elasticity. Cross Elasticity of Demand. Elasticity of Supply. Elasticity and Strange Percent Changes. Demand Curve as Marginal Benefit Curve. Consumer Surplus Introduction. Total Consumer Surplus as Area. Producer Surplus. Rent Control and Deadweight Loss. Minimum Wage and Price Floors. Taxation and Dead Weight Loss. Percentage Tax on Hamburgers. Taxes and Perfectly Inelastic Demand. Taxes and Perfectly Elastic Demand. Marginal Utility. Equalizing Marginal Utility per Dollar Spent. Deriving Demand Curve from Tweaking Marginal Utility per Dollar. Budget Line. Optimal Point on Budget Line. Types of Indifference Curves. Economic Profit vs Accounting Profit. Depreciation and Opportunity Cost of Capital. Fixed, Variable, and Marginal Cost.. Visualizing Average Costs and Marginal Costs as Slope. Marginal Cost and Average Total Cost. Marginal Revenue and Marginal Cost. Marginal Revenue Below Average Total Cost. Long Term Supply Curve and Economic Profit. Perfect Competition. Monopoly Basics. Review of Revenue and Cost Graphs for a Monopoly. Monopolist Optimizing Price (part 1)- Total Revenue.. Monopolist Optimizing Price (part 2)- Marginal Revenue. Monopolist Optimizing Price (part 3)- Dead Weight Loss.avi. Optional Calculus Proof to Show that MR has Twice Slope of Demand. Oligopolies and Monopolistic Competition. Monopolistic Competition and Economic Profit. Oligopolies, Duopolies, Collusion, and Cartels. Prisoners' Dilemma and Nash Equilibrium. More on Nash Equilibrium. Why Parties to Cartels Cheat. Game Theory of Cheating Firms. Negative Externalities. Taxes for Factoring in Negative Externalities. Positive Externalities. Tragedy of the Commons. First Degree Price Discrimination. A Firm's Marginal Product Revenue Curve. How Many People to Hire Given the MPR curve. Adding Demand Curves.

Videos on finance and macroeconomics. Introduction to interest. Interest (part 2). Introduction to Present Value. Present Value 2. Present Value 3. Present Value 4 (and discounted cash flow). Introduction to Balance Sheets. More on balance sheets and equity. Home equity loans. Renting vs. Buying a home. Renting vs. buying a home (part 2). Renting vs. Buying (detailed analysis). The housing price conundrum. Housing price conundrum (part 2). Housing Price Conundrum (part 3). Housing Conundrum (part 4). What it means to buy a company's stock. Bonds vs. Stocks. Shorting Stock. Shorting Stock 2. Is short selling bad?. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. Return on capital. Credit Default Swaps (CDS) Intro. Mortgage Back Security Overview. Collateralized Debt Obligation Overview. Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation (CDO). Introduction to the yield curve. Introduction to compound interest and e. Compound Interest and e (part 2). Compound Interest and e (part 3). Compound Interest and e (part 4). Bailout 1: Liquidity vs. Solvency. Bailout 2: Book Value. Bailout 3: Book value vs. market value. Bailout 4: Mark-to-model vs. mark-to-market. Bailout 5: Paying off the debt. Bailout 6: Getting an equity infusion. Bailout 7: Bank goes into bankruptcy. Bailout 8: Systemic Risk. Bailout 9: Paulson's Plan. Bailout 10: Moral Hazard. Credit Default Swaps. Credit Default Swaps 2. Investment vs. Consumption 1. Investment vs. Consumption 2. Bailout 11: Why these CDOs could be worth nothing. Bailout 12: Lone Star Transaction. Bailout 13: Does the bailout have a chance of working?. Wealth Destruction 1. Wealth Destruction 2. Bailout 14: Possible Solution. Bailout 15: More on the solution. Banking 1. Banking 2: A bank's income statement. Banking 3: Fractional Reserve Banking. Banking 4: Multiplier effect and the money supply. Personal Bankruptcy: Chapters 7 and 13. Introduction to Compound Interest. The Rule of 72 for Compound Interest. Annual Percentage Rate (APR) and Effective APR. Introduction to Bonds. Relationship between bond prices and interest rates. Introduction to Mortgage Loans. Traditional IRAs. Roth IRAs. 401(k)s. Payday Loans. Institutional Roles in Issuing and Processing Credit Cards. Ponzi Schemes. Currency Exchange Introduction. Currency Effect on Trade. Currency Effect on Trade Review. Pegging the Yuan. Chinese Central Bank Buying Treasuries. American-Chinese Debt Loop. Debt Loops Rationale and Effects. American Call Options. Basic Shorting. American Put Options. Call Option as Leverage. Put vs. Short and Leverage. Call Payoff Diagram. Put Payoff Diagram. Long Straddle. Put as Insurance. Put-Call Parity. Put Writer Payoff Diagrams. Call Writer Payoff Diagram. Arbitrage Basics. Put-Call Parity Arbitrage I. Put-Call Parity Arbitrage II. Put-Call Parity Clarification. Actual Option Quotes. Option Expiration and Price. Forward Contract Introduction. Futures Introduction. Motivation for the Futures Exchange. Futures Margin Mechanics. Verifying Hedge with Futures Margin Mechanics. Futures and Forward Curves. Contango from Trader Perspective. Severe Contango Generally Bearish. Backwardation Bullish or Bearish. Futures Curves II. Contango. Backwardation. Contango and Backwardation Review. Upper Bound on Forward Settlement Price. Lower Bound on Forward Settlement Price. Arbitraging Futures Contract. Arbitraging Futures Contracts II. Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation. Basic Capital Structure Differences. Market Capitalization. Market Value of Assets. LIBOR. Fair Value Accounting. Tax Deductions Introduction. Alternative Minimum Tax. Term Life Insurance and Death Probability. Back of Envelope Office Space Conundrum. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Open-Ended Mutual Fund (Part 1). Open-End Mutual Fund Redemptions. Closed-End Mutual Funds. Exchange Traded Funds (ETFs). Hedge Funds Intro. Hedge Fund Structure and Fees. Are Hedge Funds Bad?. Hedge Funds, Venture Capital, and Private Equity. Treasury Bond Prices and Yields. Annual Interest Varying with Debt Maturity. The Yield Curve. Fed Open Market Operations. Quantitative Easing. More on Quantitative Easing (and Credit Easing). Hedge Fund Strategies - Long Short 1. Hedge Fund Strategies - Long Short 2. Hedge Fund Strategies - Merger Arbitrage 1. Stock Dilution. Acquisitions with Shares. Price Behavior After Announced Acquisition. Simple Merger Arb with Share Acquisition. Basic Leveraged Buyout (LBO). Corporate Debt versus Traditional Mortgages. AMT Overview. Open market operations and Quantitative Easing Overview. Another Quantitative Easing Video. US and Japanese Quantitative Easing. Term and Whole Life Insurance Policies 2. Term and Whole Life Insurance Policies. Estate Tax Introduction. Human Capital. Risk and Reward Introduction. Futures Fair Value in the Pre-Market. What is Inflation. Inflation Data. Moderate Inflation in a Good Economy. Stagflation. Real and Nominal Return. Calculating Real Return in Last Year Dollars. Relation Between Nominal and Real Returns and Inflation. Use Cases for Credit Default Swaps. Financial Weapons of Mass Destruction. Deflation. Velocity of Money Rather than Quantity Driving Prices. Deflation Despite Increases in Money Supply. Deflationary Spiral. Hyperinflation. Estate Tax Basics. Term and Whole Life. Open-Ended Mutual Funds. Unemployment Rate Primer (v2). Time Value of Money. Mortgage Interest Rates. Inflation Overview. Basics of US Income Tax Rate Schedule. Carry Trade Basics. Interpreting Futures Fair Value in the PreMarket. Interest Rate Swap 1. Interest Rate Swap 2. Transfer Pricing and Tax Havens.

In this course, you will explore several structured, risk management approaches that guide information security decision-making.

This course emphasizes the role of economics regarding its influence on food prices, the environment, and government policies. The primary objective of this course is to explore the basic tool kit of economic concepts that will enable students to critically analyze the choices they face as consumers and world citizens.

Learn to defend and protect vital company information using the latest technology and defense strategies. Analyze internal and external threats to proactively prevent information attacks. Gain experience by solving real-world problems and leave the class equipped to establish and oversee information security.

This course is part of the MITx MicroMasters program in Data, Economics, and Development Policy (DEDP). To audit this course, click “Enroll Now” in the green button at the top of this page.

To enroll in the MicroMasters track or to learn more about this program and how it integrates with MIT’s new blended Master’s degree, go to MITx’s MicroMasters portal.

This is a course for those who are interested in the challenge posed by massive and persistent world poverty, and are hopeful that economists might have something useful to say about this challenge. The questions we will take up include: Is extreme poverty a thing of the past? What is economic life like when living under a dollar per day? Are the poor always hungry? How do we make schools work for poor citizens? How do we deal with the disease burden? Is microfinance invaluable or overrated? Without property rights, is life destined to be "nasty, brutish and short"? Should we leave economic development to the market? Should we leave economic development to non-governmental organizations (NGOs)? Does foreign aid help or hinder? Where is the best place to intervene? And many others.

At the end of this course, you should have a good sense of the key questions asked by scholars interested in poverty today, and hopefully a few answers as well.

Think about the oldest and most familiar principles of American law, property and proportional liability, in a new and surprising way, and learn to apply economic reasoning to an especially important and interesting aspect of life.

Demand Curve as Marginal Benefit Curve. Consumer Surplus Introduction. Total Consumer Surplus as Area. Producer Surplus. Rent Control and Deadweight Loss. Minimum Wage and Price Floors. Taxation and Dead Weight Loss. Percentage Tax on Hamburgers. Taxes and Perfectly Inelastic Demand. Taxes and Perfectly Elastic Demand. Negative Externalities. Taxes for Factoring in Negative Externalities. Positive Externalities. Tragedy of the Commons. Demand Curve as Marginal Benefit Curve. Consumer Surplus Introduction. Total Consumer Surplus as Area. Producer Surplus. Rent Control and Deadweight Loss. Minimum Wage and Price Floors. Taxation and Dead Weight Loss. Percentage Tax on Hamburgers. Taxes and Perfectly Inelastic Demand. Taxes and Perfectly Elastic Demand. Negative Externalities. Taxes for Factoring in Negative Externalities. Positive Externalities. Tragedy of the Commons.

Topics covered in a traditional college level introductory macroeconomics course. Introduction to Economics. Circular Flow of Income and Expenditures. Parsing Gross Domestic Product. More on Final and Intermediate GDP Contributions. Investment and Consumption. Income and Expenditure Views of GDP. Components of GDP. Examples of Accounting for GDP. Real GDP and Nominal GDP. GDP Deflator. Example Calculating Real GDP with a Deflator. Introduction to Inflation. Actual CPI-U Basket of Goods. Inflation Data. Moderate Inflation in a Good Economy. Stagflation. Real and Nominal Return. Calculating Real Return in Last Year Dollars. Relation Between Nominal and Real Returns and Inflation. Deflation. Velocity of Money Rather than Quantity Driving Prices. Deflation Despite Increases in Money Supply. Deflationary Spiral. Hyperinflation. Unemployment Rate Primer. Phillips Curve. Interest as Rent for Money. Money Supply and Demand Impacting Interest Rates. The Business Cycle. Aggregate Demand. Shifts in Aggregate Demand. Long-Run Aggregate Supply. Short Run Aggregate Supply. Demand-Pull Inflation under Johnson. Real GDP driving Price. Cost Push Inflation. Monetary and Fiscal Policy. Tax Lever of Fiscal Policy. Breakdown of Gas Prices. Short-Run Oil Prices. Keynesian Economics. Risks of Keynesian Thinking. Overview of Fractional Reserve Banking. Weaknesses of Fractional Reserve Lending. Full Reserve Banking. Money Supply- M0 M1 and M2. Simple Fractional Reserve Accounting part 1. Simple Fractional Reserve Accounting (part 2). MPC and Multiplier. Mathy Version of MPC and Multiplier (optional). Consumption Function Basics. Generalized Linear Consumption Function. Consumption Function with Income Dependent Taxes. Keynesian Cross. Details on Shifting Aggregate Planned Expenditures. Keynesian Cross and the Multiplier. Investment and Real Interest Rates. Connecting the Keynesian Cross to the IS-Curve. Loanable Funds Interpretation of IS Curve. LM part of the IS-LM model. Government Spending and the IS-LM model. Balance of Payments- Current Account. Balance of Payments- Capital Account. Why Current and Capital Accounts Net Out. Accumulating Foreign Currency Reserves. Using Reserves to Stabilize Currency. Speculative Attack on a Currency. Financial Crisis in Thailand Caused by Speculative Attack. Math Mechanics of Thai Banking Crisis.

American Call Options. Basic Shorting. American Put Options. Call Option as Leverage. Put vs. Short and Leverage. Call Payoff Diagram. Put Payoff Diagram. Put as Insurance. Put-Call Parity. Long Straddle. Put Writer Payoff Diagrams. Call Writer Payoff Diagram. Arbitrage Basics. Put-Call Parity Arbitrage I. Put-Call Parity Arbitrage II. Put-Call Parity Clarification. Actual Option Quotes. Option Expiration and Price. Forward Contract Introduction. Futures Introduction. Motivation for the Futures Exchange. Futures Margin Mechanics. Verifying Hedge with Futures Margin Mechanics. Futures and Forward Curves. Contango from Trader Perspective. Severe Contango Generally Bearish. Backwardation Bullish or Bearish. Futures Curves II. Contango. Backwardation. Contango and Backwardation Review. Upper Bound on Forward Settlement Price. Lower Bound on Forward Settlement Price. Arbitraging Futures Contract. Arbitraging Futures Contracts II. Futures Fair Value in the Pre-Market. Interpreting Futures Fair Value in the PreMarket. Mortgage Back Security Overview. Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation Overview. Collateralized Debt Obligation (CDO). Credit Default Swaps (CDS) Intro. Credit Default Swaps. Credit Default Swaps 2. Use Cases for Credit Default Swaps. Financial Weapons of Mass Destruction. Interest Rate Swap 1. Interest Rate Swap 2. Introduction to the Black Scholes Formula. Implied volatility. American Call Options. Basic Shorting. American Put Options. Call Option as Leverage. Put vs. Short and Leverage. Call Payoff Diagram. Put Payoff Diagram. Put as Insurance. Put-Call Parity. Long Straddle. Put Writer Payoff Diagrams. Call Writer Payoff Diagram. Arbitrage Basics. Put-Call Parity Arbitrage I. Put-Call Parity Arbitrage II. Put-Call Parity Clarification. Actual Option Quotes. Option Expiration and Price. Forward Contract Introduction. Futures Introduction. Motivation for the Futures Exchange. Futures Margin Mechanics. Verifying Hedge with Futures Margin Mechanics. Futures and Forward Curves. Contango from Trader Perspective. Severe Contango Generally Bearish. Backwardation Bullish or Bearish. Futures Curves II. Contango. Backwardation. Contango and Backwardation Review. Upper Bound on Forward Settlement Price. Lower Bound on Forward Settlement Price. Arbitraging Futures Contract. Arbitraging Futures Contracts II. Futures Fair Value in the Pre-Market. Interpreting Futures Fair Value in the PreMarket. Mortgage Back Security Overview. Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation Overview. Collateralized Debt Obligation (CDO). Credit Default Swaps (CDS) Intro. Credit Default Swaps. Credit Default Swaps 2. Use Cases for Credit Default Swaps. Financial Weapons of Mass Destruction. Interest Rate Swap 1. Interest Rate Swap 2. Introduction to the Black Scholes Formula. Implied volatility.

How do you decide what to produce or trade? How can you maximize happiness in a world of scarcity. What are you giving up when you choose something (i.e., opportunity cost)?. Production Possibilities Frontier. Opportunity Cost. Increasing Opportunity Cost. Allocative Efficiency and Marginal Benefit. Economic Growth through Investment. Comparative Advantage Specialization and Gains from Trade. Comparative Advantage and Absolute Advantage. Marginal Utility. Equalizing Marginal Utility per Dollar Spent. Deriving Demand Curve from Tweaking Marginal Utility per Dollar. Budget Line. Indifference Curves and Marginal Rate of Substitution. Optimal Point on Budget Line. Types of Indifference Curves. Production Possibilities Frontier. Opportunity Cost. Increasing Opportunity Cost. Allocative Efficiency and Marginal Benefit. Economic Growth through Investment. Comparative Advantage Specialization and Gains from Trade. Comparative Advantage and Absolute Advantage. Marginal Utility. Equalizing Marginal Utility per Dollar Spent. Deriving Demand Curve from Tweaking Marginal Utility per Dollar. Budget Line. Indifference Curves and Marginal Rate of Substitution. Optimal Point on Budget Line. Types of Indifference Curves.

Economic profit vs. accounting profit. Average total cost (ATC) and marginal cost (MC). Marginal product of labor (MPL). Price discrimination. Economic Profit vs Accounting Profit. Depreciation and Opportunity Cost of Capital. Marginal Cost and Average Total Cost. Marginal Revenue and Marginal Cost. Marginal Revenue Below Average Total Cost. Long Term Supply Curve and Economic Profit. Fixed, Variable, and Marginal Cost.. Visualizing Average Costs and Marginal Costs as Slope. A Firm's Marginal Product Revenue Curve. How Many People to Hire Given the MPR curve. Adding Demand Curves. First Degree Price Discrimination. Economic Profit vs Accounting Profit. Depreciation and Opportunity Cost of Capital. Marginal Cost and Average Total Cost. Marginal Revenue and Marginal Cost. Marginal Revenue Below Average Total Cost. Long Term Supply Curve and Economic Profit. Fixed, Variable, and Marginal Cost.. Visualizing Average Costs and Marginal Costs as Slope. A Firm's Marginal Product Revenue Curve. How Many People to Hire Given the MPR curve. Adding Demand Curves. First Degree Price Discrimination.

Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation. Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation.

Discussions of economic topics and how they relate to current events. Unemployment. Unemployment Rate Primer (v2). Unemployment Rate Primer. Simple Analysis of Cost per Job Saved from Stimulus. Unemployment. Unemployment Rate Primer (v2). Unemployment Rate Primer. Simple Analysis of Cost per Job Saved from Stimulus.

What it means to buy a company's stock. Bonds vs. Stocks. Basic Shorting. Shorting Stock. Shorting Stock 2. Is short selling bad?. Gross and Operating Profit. Basic Capital Structure Differences. Market Capitalization. Market Value of Assets. Price and Market Capitalization. Introduction to the Income Statement. Earnings and EPS. Introduction to the Price-to-Earnings Ratio. P/E Discussion. ROA Discussion 1. ROA Discussion 2. Depreciation. Amortization. P/E Conundrum. Enterprise Value. EBITDA. Raising money for a startup. Getting a seed round from a VC. Going back to the till: Series B. An IPO. More on IPOs. Equity vs. Debt. Bonds vs. Stocks. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. Stock Dilution. Acquisitions with Shares. Price Behavior After Announced Acquisition. Simple Merger Arb with Share Acquisition. Basic Leveraged Buyout (LBO). Corporate Debt versus Traditional Mortgages. Introduction to Bonds. Introduction to the yield curve. Relationship between bond prices and interest rates. Treasury Bond Prices and Yields. Annual Interest Varying with Debt Maturity. The Yield Curve. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. What it means to buy a company's stock. Bonds vs. Stocks. Basic Shorting. Shorting Stock. Shorting Stock 2. Is short selling bad?. Gross and Operating Profit. Basic Capital Structure Differences. Market Capitalization. Market Value of Assets. Price and Market Capitalization. Introduction to the Income Statement. Earnings and EPS. Introduction to the Price-to-Earnings Ratio. P/E Discussion. ROA Discussion 1. ROA Discussion 2. Depreciation. Amortization. P/E Conundrum. Enterprise Value. EBITDA. Raising money for a startup. Getting a seed round from a VC. Going back to the till: Series B. An IPO. More on IPOs. Equity vs. Debt. Bonds vs. Stocks. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. Stock Dilution. Acquisitions with Shares. Price Behavior After Announced Acquisition. Simple Merger Arb with Share Acquisition. Basic Leveraged Buyout (LBO). Corporate Debt versus Traditional Mortgages. Introduction to Bonds. Introduction to the yield curve. Relationship between bond prices and interest rates. Treasury Bond Prices and Yields. Annual Interest Varying with Debt Maturity. The Yield Curve. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring.

Perfect Competition. Monopoly Basics. Monopolist Optimizing Price (part 1)- Total Revenue.. Monopolist Optimizing Price (part 2)- Marginal Revenue. Monopolist Optimizing Price (part 3)- Dead Weight Loss.avi. Optional Calculus Proof to Show that MR has Twice Slope of Demand. Review of Revenue and Cost Graphs for a Monopoly. Oligopolies and Monopolistic Competition. Monopolistic Competition and Economic Profit. Oligopolies, Duopolies, Collusion, and Cartels. Perfect Competition. Monopoly Basics. Monopolist Optimizing Price (part 1)- Total Revenue.. Monopolist Optimizing Price (part 2)- Marginal Revenue. Monopolist Optimizing Price (part 3)- Dead Weight Loss.avi. Optional Calculus Proof to Show that MR has Twice Slope of Demand. Review of Revenue and Cost Graphs for a Monopoly. Oligopolies and Monopolistic Competition. Monopolistic Competition and Economic Profit. Oligopolies, Duopolies, Collusion, and Cartels.

Prisoners' Dilemma and Nash Equilibrium. More on Nash Equilibrium. Why Parties to Cartels Cheat. Game Theory of Cheating Firms. Prisoners' Dilemma and Nash Equilibrium. More on Nash Equilibrium. Why Parties to Cartels Cheat. Game Theory of Cheating Firms.

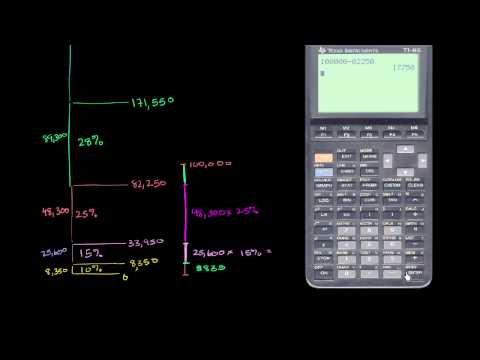

Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens. Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens.

Learn how markets work, what they accomplish well and what their limitations are.

Introduction to Balance Sheets. More on balance sheets and equity. Home equity loans. Introduction to Mortgage Loans. Mortgage Interest Rates. Short sale basics. Advanced: Geometric series sum to figure out mortgage payments. Renting vs. Buying a home. Renting vs. buying a home (part 2). Renting vs. Buying (detailed analysis). The housing price conundrum. Housing price conundrum (part 2). Housing Price Conundrum (part 3). Housing Conundrum (part 4). The housing price conundrum. Housing price conundrum (part 2). Housing Price Conundrum (part 3). Housing Conundrum (part 4). Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation (CDO). Credit Default Swaps. Credit Default Swaps 2. Wealth Destruction 1. Wealth Destruction 2. CNN: Understanding the Crisis. Bailout 1: Liquidity vs. Solvency. Bailout 2: Book Value. Bailout 3: Book value vs. market value. Bailout 4: Mark-to-model vs. mark-to-market. Bailout 5: Paying off the debt. Bailout 6: Getting an equity infusion. Bailout 7: Bank goes into bankruptcy. Bailout 8: Systemic Risk. Bailout 9: Paulson's Plan. Bailout 10: Moral Hazard. Bailout 11: Why these CDOs could be worth nothing. Bailout 12: Lone Star Transaction. Bailout 13: Does the bailout have a chance of working?. Bailout 14: Possible Solution. Bailout 15: More on the solution. Risk and Reward Introduction. Human Capital. Return on capital. Investment vs. Consumption 1. Investment vs. Consumption 2. Wealth Destruction 1. Wealth Destruction 2. Back of Envelope Office Space Conundrum. Introduction to Balance Sheets. More on balance sheets and equity. Home equity loans. Introduction to Mortgage Loans. Mortgage Interest Rates. Short sale basics. Advanced: Geometric series sum to figure out mortgage payments. Renting vs. Buying a home. Renting vs. buying a home (part 2). Renting vs. Buying (detailed analysis). The housing price conundrum. Housing price conundrum (part 2). Housing Price Conundrum (part 3). Housing Conundrum (part 4). The housing price conundrum. Housing price conundrum (part 2). Housing Price Conundrum (part 3). Housing Conundrum (part 4). Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation (CDO). Credit Default Swaps. Credit Default Swaps 2. Wealth Destruction 1. Wealth Destruction 2. CNN: Understanding the Crisis. Bailout 1: Liquidity vs. Solvency. Bailout 2: Book Value. Bailout 3: Book value vs. market value. Bailout 4: Mark-to-model vs. mark-to-market. Bailout 5: Paying off the debt. Bailout 6: Getting an equity infusion. Bailout 7: Bank goes into bankruptcy. Bailout 8: Systemic Risk. Bailout 9: Paulson's Plan. Bailout 10: Moral Hazard. Bailout 11: Why these CDOs could be worth nothing. Bailout 12: Lone Star Transaction. Bailout 13: Does the bailout have a chance of working?. Bailout 14: Possible Solution. Bailout 15: More on the solution. Risk and Reward Introduction. Human Capital. Return on capital. Investment vs. Consumption 1. Investment vs. Consumption 2. Wealth Destruction 1. Wealth Destruction 2. Back of Envelope Office Space Conundrum.

Trusted paper writing service WriteMyPaper.Today will write the papers of any difficulty.