Courses tagged with "Amnesty InternationalX" (9)

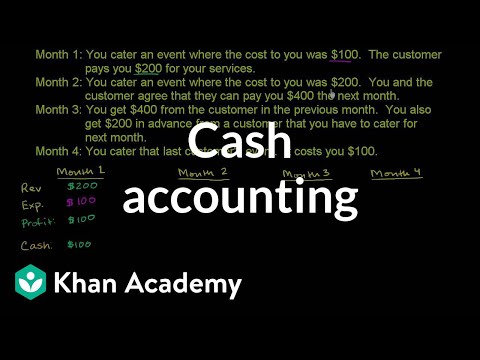

Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation. Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation.

Learn the basics of Accounting including: the accounting cycle, inventory, depreciation, receivables, and more!

This course will improve your fluency in financial accounting, the language of business. You will learn how to read, understand, and analyze most of the information provided by companies in their financial statements. These skills will help you make more informed decisions using financial information.

A series of 17 videos describing the essential ideas typically covered in a university-level accounting principles cours

Accounting can be considered the language of business. If you are learning accounting for the first time, embracing its foundational concepts may be a challenging process. Mastery of accounting primarily rests in your ability to critically think through and synthesize the information as it applies to a given situation. You should approach the learning of accounting the same way you would approach learning a foreign language; It will take time and practice to ensure you remember the concepts. There are a number of sub-disciplines that fall under the umbrella of “accounting,” but in this course, we will be focused on financial accounting. Accounting as a business discipline can be viewed as a system of compiled data. The word data should not be confused with “information.” In terms of accounting, “data” should be viewed as the raw transactions or business activity that happens within any business entity. For example: Someone uses $30,000 of their savings to start a business. The use of these f…

This course introduces the basic financial statements used by most businesses, as well as the essential tools used to prepare them. This course will serve as a resource to help business students succeed in their upcoming university-level accounting classes, and as a refresher for upper division accounting students who are struggling to recall elementary concepts essential to more advanced accounting topics. Business owners will also benefit from this class by gaining essential skills necessary to organize and manage information pertinent to operating their business. At the conclusion of the class, students will understand the balance sheet, income statement, and cash flow statement. They will be able to differentiate between cash basis and accrual basis techniques, and know when each is appropriate. They

This course examines the underlying concepts, processes, and accountability function of accounting and the scientific foundation for why accounting fulfills such an important role in both ancient and modern societies.

Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation. Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation.

Trusted paper writing service WriteMyPaper.Today will write the papers of any difficulty.