Courses tagged with "University of Strathclyde" (2)

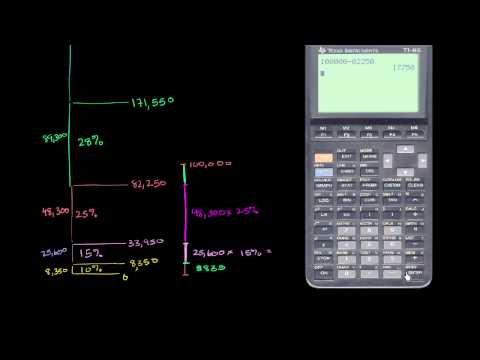

Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens. Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens.

Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens. Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens.

Trusted paper writing service WriteMyPaper.Today will write the papers of any difficulty.