Online courses directory (841)

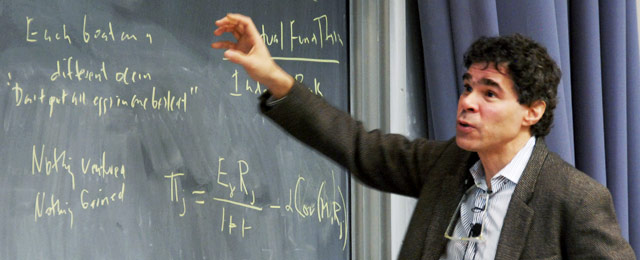

This course is an introduction to the theory and practice of financial engineering and risk management. We consider the pricing of derivatives, portfolio optimization and risk management and cast a critical eye on how these are used in practice. We will also feature some interview modules with Emanuel Derman .

This course provides an introduction to various classes of derivative securities and we will learn how to price them using "risk-neutral pricing". In the follow-up to this course (FE & RM Part II) we will consider portfolio optimization, risk management and more advanced examples of derivatives pricing including, for example, real options and energy derivatives.

This course follows on from FE & RM Part I. We will consider portfolio optimization, risk management and some advanced examples of derivatives pricing that draw from structured credit, real options and energy derivatives. We will also cast a critical eye on how financial models are used in practice.

What you do not know about money can really affect your entire life! Financial Literacy is a free, online introductory course about personal financial management. In this interactive multimedia course, a series of seven dynamic modules covering everything from how to set up your first bank account to planning for your retirement will put you on the path to financial fitness!

Develop your knowledge of personal finance, such as how to control, invest and protect your finances.

Financial Management studies corporate finance and capital markets, emphasizing the financial aspects of managerial decisions. It touches on all areas of finance, including the valuation of real and financial assets, risk management and financial derivatives, the trade-off between risk and expected return, and corporate financing and dividend policy. The course draws heavily on empirical research to help guide managerial decisions.

An overview of the ideas, methods, and institutions that permit human society to manage risks and foster enterprise.

Financial institutions are a pillar of civilized society, supporting people in their productive ventures and managing the economic risks they take on. The workings of these institutions are important to comprehend if we are to predict their actions today and their evolution in the coming information age. The course strives to offer understanding of the theory of finance and its relation to the history, strengths and imperfections of such institutions as banking, insurance, securities, futures, and other derivatives markets, and the future of these institutions over the next century.

Explore a career in financial planning, including working with clients and the financial planning process.

This course attempts to explain the role and the importance of the financial system in the global economy. Rather than separating off the financial world from the rest of the economy, financial equilibrium is studied as an extension of economic equilibrium. The course also gives a picture of the kind of thinking and analysis done by hedge funds.

Learn how debt and equity can be used to finance infrastructure investments and how investors approach infrastructure investments.

By Stephanie Marrus and Naeem Zafar

Learn how to succeed in the Forex Market by using simple trend following techniques.

An Overview Of The Forex Market To Help You Determine If Getting Involved Is For You. / Get Your Feet Wet For Free.

learn about the basics of forex trading and how to use the Meta Trader 4 platform

For aspiring traders to quickly pick up the basics of FX, FX trading and Price Action Trading Methodology.

This course teaches trading tactics in the forex market using live events to determine price direction. It combines both

Learn how to MAKE A LIVING & BUILD WEALTH in the FOREX market

Learn how to analyze an organization's strategy and make recommendations to improve its value creation by building your strategist's toolkit. This course will be available on demand in February 2015.

This course explores the foundations of policy making in developing countries. The goal is to spell out various policy options and to quantify the trade-offs between them. We will study the different facets of human development: education, health, gender, the family, land relations, risk, informal and formal norms and institutions. This is an empirical class. For each topic, we will study several concrete examples chosen from around the world. While studying each of these topics, we will ask: What determines the decisions of poor households in developing countries? What constraints are they subject to? Is there a scope for policy (by government, international organizations, or non-governmental organizations (NGOs))? What policies have been tried out? Have they been successful?

Trusted paper writing service WriteMyPaper.Today will write the papers of any difficulty.