Courses tagged with "Book distribution" (540)

There is no shortage of advice on how to communicate, but knowing which advice to pay attention to, and how to apply the right communication strategy to achieve a given objective, or even to avoid making things worse, is not easy.

Evidence-based business communication focuses on evaluating the evidence in support of different communication strategies, and guiding managers to identify the best strategy for different communication objectives. Using the evidence-based management (EBM) framework, this communications course provides learners with the tools to evaluate the quality of their communication efforts.

The communications skills developed in this course are particularly valuable for those interested in pursuing a marketing or communications role, marcomms professionals emerging leaders, established managers, and entrepreneurs.

This course is part of the Evidence-Based Management MicroMasters Program.

Evidence-based global management explores how traditional management theory and concepts apply in the global context.

The world around us has never felt so small. Modern telecommunications and affordable long distance travel have exposed people to different cultures, and created unprecedented opportunities for globally-minded organizations. However, the risks of globalization are enormous, and costly mistakes and failure are more common than success.

This global business course will critically review existing and new evidence in the areas of culture, market selection, partnering, and strategy to ensure that aspiring managers are provided with the knowledge and skills to be successful in a global market.

The knowledge and skills developed in this course are particularly valuable for emerging global leaders, established managers of multi-national corporations, and entrepreneurs with an eye to import export.

This course is part of the Evidence-Based Management MicroMasters Programs.

The context in which managers work has changed dramatically over the past 50 years. And yet, the majority of business schools still teach the same foundational theories and management concepts.

In this management course, students will spend time dissecting the evidence in support of these foundational theories and concepts. Students will also learn to critically assess the relevance of existing management practice and knowledge in modern organisations, and evaluate the potential of emerging research and evidence in key management domains. Learners will explore the evolution of management thinking, organizational design, human resource management and more.

The knowledge and skills developed in this course are particularly valuable for emerging leaders, established managers, and entrepreneurs.

This course is part of the Evidence-Based Management MicroMasters Program.

This business and management course introduces students to an evidence-based management (EBM) framework that shows how maturity across six key domains is linked to improved leadership competency. The key domains are:

- Framing the problem (Ask);

- Gathering evidence (Acquire);

- Evaluating evidence (Appraise);

- Synthesizing findings (Aggregate);

- Implementation (Apply)

- Evaluating the outcomes (Assess).

Graduate business education has come under fire in recent years for not adequately preparing students for the challenge of managing in a complex, information-rich, and rapidly changing commercial environment. This was clearly demonstrated during the global financial crisis which exposed the inability of graduates from leading business schools to adapt what they had learnt to this new reality.

Evidence-based practice in management is a response to this situation. This business course focuses on exposing students to the latest academic thinking, while also equipping students to be critical and analytical thinkers that challenge established beliefs, and utilize the best available evidence to inform ethical decision making. Learn the EBM framework, how to analyze research, use critical thinking and more to make better business decisions.

The knowledge and skills developed in this course will prepare students to confront future business challenges. These business and management capabilities are critical for emerging leaders, established managers, and entrepreneurs.

This course provides the foundation for all other courses in the Evidence-Based Management MicroMasters Program.

Project management has emerged as a critical organizational capability in recent years. In parallel with this increased prominence has been the emergence of the “professional project manager,” supported by a sophisticated suite of project management tools and techniques.

Evidence-based project management will evaluate the accumulated data, evidence and research in support of different project management strategies, tools and techniques.

The critical thinking abilities, knowledge and decision-making skills developed in this course are particularly valuable for project managers, emergent leaders, and established managers.

This course is part of the Evidence-Based Management MicroMasters Program.

Evidence-based marketing provides the knowledge and skills needed to navigate the brave new world of digital marketing, to develop a marketing mix, and to create cost-effective marketing strategies that cut through the clutter.

There are plenty of courses that will teach you the principles and practices of marketing, and plenty of books that will introduce you to the next “big” thing. This is particularly true in the Internet age, with new digital marketing opportunities seeming to appear daily. Some have even questioned whether the basic principles and practices of marketing still apply in this new digital world.

Drawing on the evidence-based framework, this marketing course teaches managers how to evaluate the evidence in support of new and existing marketing strategies, guiding them to identify the best strategy for different stakeholders, and giving them the tools to evaluate the impact of their marketing activities.

The knowledge and skills developed in this course are an important addition to the arsenal of marketing analysts, emerging and established marketing managers, and market-oriented entrepreneurs.

This course is part of the Evidence-Based Management MicroMasters Program.

A hallmark of success for the world’s largest and most successful companies can be found in the way they value and use information. Unfortunately, the vast majority of firms have neither the knowledge nor skills to fully exploit their information assets.

Evidence-based technology management focuses on properly evaluating evidence in support of different technology management strategies. The goal is to give managers the capabilities to better use their information assets via a more effective use of technology and technology fundamentals to create a competitive advantage.

This business course will help you understand the strategic value of information by using analytics. It will also provide an overview of emergent technologies and trends, and help prepare you for a technology-enabled future.

The knowledge and skills developed in this course are particularly valuable for business analysts, aspiring chief technology officers and chief information officers, and tech-entrepreneurs.

This course is part of the Evidence-Based Management MicroMasters Program.

Family businesses are the most common type of enterprise in the world and perhaps the most complex. This business and management course will introduce you to the unique skills and knowledge needed to manage and sustain healthy family enterprises. Core topics include strategy, leadership, conflict resolution, entrepreneurship and communication.

From global firms like Nike, Heineken, Hermes, IKEA, Bharti Airtel, Toyota, Lee Kum Kee, and Hershey, to small local establishments, family firms drive economies and employment around the globe. This course is designed for anyone whose work intersects a family business – whether you are an entrepreneur, an owner, an employee, a family member or an advisor to family business.

Join two world-renowned experts who consult to 150+ families around the globe and acquire new skills and knowledge critical to longevity and success within family enterprises.

Made possible with the generous support of Bank of Montreal

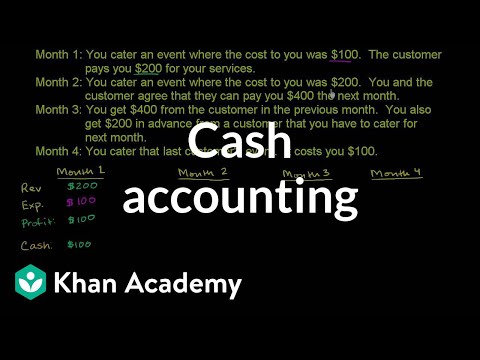

Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation. Cash Accounting. Accrual Basis of Accounting. Comparing Accrual and Cash Accounting. Balance Sheet and Income Statement Relationship. Basic Cash Flow Statement. Doing the example with Accounts Payable growing. Fair Value Accounting. Expensing a Truck leads to inconsistent performance. Depreciating the truck. Depreciation in Cash Flow. Amortization and Depreciation.

Want to study for an MBA but are unsure of basic financial concepts? This business and management course prepares you for studying finance in an MBA program.

You will learn key financial topics such as present value, Internal Rate of Return (IRR), capital budgeting, equity, bonds, diversification, portfolio choice and the Capital Asset Pricing Model (CAPM), all of which are often discussed and explored in great detail in MBA programs across the globe as well as everyday business operations.

A completely online course, you can work wherever and whenever you choose: at home, in the workplace, at a library, coffee shop or even while travelling (with the appropriate network access).

This course employs a ‘supported learning’ model. To help you achieve the optimum learning outcomes from this module, Imperial College Business School provides access to an expert online tutor who will support you through the learning materials and associated activities.

No previous financial knowledge is needed. Join us as you start your journey into the world of finance for management.

Want to learn how to think clearly about important financial decisions and improve your financial literacy? Finance for Everyone will showcase the beauty and power of finance. This introductory finance course will be a gateway into the world of finance and will examine multiple applications to apply to your everyday life. Join us to better understand how to apply frameworks and tools to make smart financial choices.

You will be able to value the impact of different choices available to you: from renting or buying, evaluating car, home and student loans, or deciding whether to go to college versus pursuing a new idea to simply understanding how the financial world works.

Starting with time value of money, the course will help you develop a full appreciation for the many applications of finance. Using real world examples, the course will enable you to understand and analyze many personal and professional decisions we confront on a daily basis. You will understand stocks and bonds, learn to allocate scarce resources in a value-add way, and adopt smart tools for making every day decisions.

Finance is simultaneously a way of thinking and a set of tools. Finance is everywhere. There are no prerequisites for this course except for a sense of curiosity and a positive attitude. However, a comfort level with algebra and numbers and an understanding of accounting (the language of business) will clearly help. We will, however, try to cover everything starting with fundamentals and highlight when there is a need to do some further work in specific subjects.

In this course gain a basic understanding of finance and accounting concepts to drive your organization's growth. Upon completion of this course, you will have gained general financial knowledge and an in-depth understanding of the impact of your decisions outside your functional area.

For exams from 23rd September 2017, this course introduces the principles of financial accounting, and will allow learners to demonstrate technical proficiency in the use of double-entry techniques, including the preparation and interpretation of basic financial statements for sole traders, partnerships and companies. You will also learn how to:

- Record, process and report business transactions

- Use the trial balance and identify and correct errors

- Draft financial statements

- Understand the qualitative characteristics of useful information

Completion of this course will also prepare you for the ACCA ‘Financial Accounting’ exam (FFA/F3), which leads to a Diploma in Accounting and Business.

To check availability of this course in your country please click here.

This course does not offer an edX certificate.

Those learners who would like to earn an award will have the opportunity to register with ACCA as a student, take computer based exams and gain the ACCA Diploma in Accounting and Business.

You can find your nearest ACCA exam centre on the ACCA website.

Are you one of those professionals who is curious and wants to learn about financial statements, but is intimidated by financial numbers and jargon? Then this course is for you!

In this course, we will demystify accounting jargon, help you understand financial statements and analyse them for better decisions. Whatever be your background – marketing, operations, supply chain, strategy, engineering or others, in today’s competitive world, you need to use and interpret crucial financial data for making informed decisions.

This course will enable you to:

- Understand the various elements of financial statements

- Apply accounting principles related to its preparation

- Use tools and techniques to analyse and interpret the key parameters of financial performance

The course has direct application and high relevance in every professional’s life. Concepts learnt in the course can be applied in day to day management for improving operations and creating value for the organization. You will also be able to assess financial implications of your decisions.

The course will be covered in an easy, simple and interactive manner through various hands-on activities, short cases and easy-to-understand examples.

No previous finance knowledge is needed. Come armed with enthusiasm and curiosity to learn.

Are financial statements a mystery to you? Do all those terms and metrics make your head spin? Do you avoid conversations with your finance leaders because you are not confident of your finance ability?

Having a solid understanding of financial terms, statements and metrics is critical to becoming a successful entrepreneur or manager. In this finance course, you will learn how to interpret and use the information contained in financial statements to make key operating decisions, evaluate business performance, and create forecasts of profits and cash flow.

This course introduces you to the form, content and definitions included in the primary financial statements: income statement, balance sheet, and cash flow statement. You will learn how to use this information to make key operating decisions, such as how to balance growth with cash constraints. You will learn how to use ratios to diagnose a company’s financial health and apply these concepts and tools to evaluate a company of your own choosing.

Eliminate your fear of accounting! Financial accounting can be fun once the barriers to learning are broken down. Through a series of learning scenarios that take you through the creation of a simple business, you will become comfortable with basic accounting tools and concepts that you need to more effectively manage your business. By the end of the course, you will become a much more confident user of financial information and will be able to effectively engage with your finance leaders.

This course is part of the Business Principles and Entrepreneurial Thought XSeries.

How do you find the money necessary to effectively manage your business? How do you know if a business opportunity is worthwhile? When should you invest in a stock, bond or company? Do you fear the financial side of growing your organization?

This finance course will take the mystery out of financial analysis and help you make the right business decisions. In order to establish your company you need to secure funding. Once you have money, you need to determine the most efficient and effective use of your capital. You also need to have the knowledge to have professional and engaging conversations with finance professionals who control access to funding.

In this course, you will discover a variety of options for funding your business and how to successfully negotiate financial opportunities. You will learn how to value and evaluate ideas to determine the appropriate benefits and costs in order to screen them correctly. Finally, you will learn how to value a business and the securities you can use to potentially fund your organization.

This course is part of the Business Principles and Entrepreneurial Thought XSeries.

In this finance course, learners will be exposed to real world decision-making rules used to prioritize projects, with several rich applications. The specific decision rules we will analyze include:

- Payback

- Internal Rate of Return

- Net Present Value

The relation between these different decision rules and value creation, or equivalently shareholder wealth maximization, will be emphasized. The foundational framework of time value of money will be used to introduce the concepts and applications, and to critically evaluate the strengths and weaknesses of alternative decision criteria. This will be followed by an exposure to the valuation of bond/debt and stocks/shares. This course will also involve some basic exposure to how the profitability of projects is measured in the real world.

This course is targeted to managers working in corporations or institutions and individuals planning to pursue a graduate degree in business (MBA).

This course is the first of four in the Corporate Financial Analysis XSeries Learn how to use decision criteria and rules to evaluate projects based on their impact on business, including payback, NPV and IRR.

Learn how to use key finance principles to understand and measure business success and to identify and promote true value creation.

Learn the fundamental principles of trading off risk and return, portfolio optimization, and security pricing—useful skills and concepts to have when making both corporate and personal financial decisions. Also explore market efficiency, behavioral finance, and firm valuation techniques.

This finance course will expose learners to the workings of global financial markets, their key institutional features, and the theoretical underpinnings of their design. Topics will include different types of financial securities such as debt, equity, convertible debt, and preferred stocks traded in the market, their relative advantages and disadvantages and the roles of institutions such as banks, credit rating agencies and institutional investors (such as pension funds and activist investors) in these markets.

The course will critically evaluate the risk-return tradeoff inherent in different financial instruments, and how managers should think about using these instruments for their firms. The course will introduce the idea of information asymmetry and conflicts of interests among various stakeholders of the firm and how various financial securities overcome these conflicts. This will be followed by a critical evaluation of recent financial crises within the context of these conflicts.

This course is for learners broadly interested in financial markets, managers working in corporations or institutions and individuals planning to pursue a graduate degree in business (MBA).

This course is the third of four in the Corporate Financial Analysis XSeries. Learn about the structure and design of global financial markets and institutions such as banks and credit rating agencies.

Trusted paper writing service WriteMyPaper.Today will write the papers of any difficulty.